philadelphia property tax rate 2022

After that date this tax will be added to the Philadelphia Tax Center. About the data.

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

Look up your property tax balance.

. Philadelphia will not reassess properties next year due to operational limitations amid the coronavirus pandemic city officials announced Wednesday. Get a property tax abatement. Philadelphia property owners will not have their home values reassessed until 2022 with some exceptions.

Get the Homestead Exemption. Bills reflecting those assessments will be issued in December of 2021 for taxes due in March of 2022. Dec 19 2019.

Pennsylvania is ranked 1120th of the 3143 counties in the United States. As a result her tax bill will have increased from 1963 to 2445 between 2018 and 2020. The citys property tax rate is 13998 of the assessed property value.

The City of Philadelphia released updated assessed values for all properties in the city on May 9. Get Real Estate Tax relief. May 03 2022 As Philly braces for property value reassessments Kenney proposes wage tax reduction and other relief The real estate boom has increased the aggregate value of residential properties.

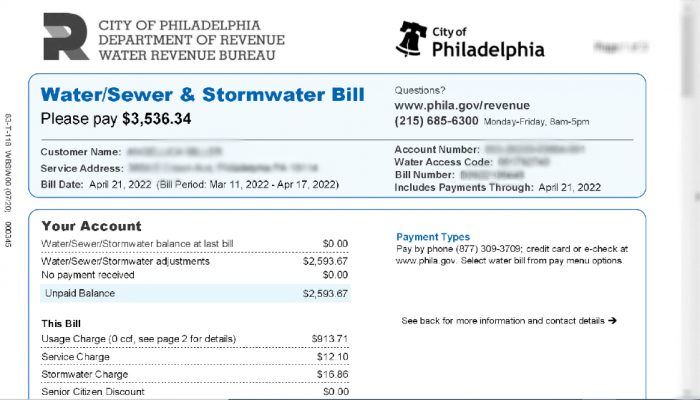

City of Philadelphia. Property tax bills are typically sent out in December and are due March 31 of each year Unsplash photoJacob Culp The Philadelphia Tribune. By phone by calling 877 309-3710.

56 out of 67 states in Pennsylvania. The City and the School District of Philadelphia impose a tax on all real estate in the City pursuant to Philadelphia Code Chapter 19-1300 as authorized by 72 PS. Paying your Philly property tax online is always best.

You can also generate address listings near a property or within an area of interest. Thats slightly below the citys estimate of more than 582000 total records. 06317 City 07681 School District 13998 Total The amount of Real Estate Tax you owe is determined by the value of your property as assessed by the Office of Property Assessment OPA.

Yearly median tax in Philadelphia County. The Inquirer analysis is based on 2023 assessment data pulled from the citys property assessment site Monday afternoon gathering about 581000 records. The real estate tax for tax year 2020 was 13998 ranking No.

Bills reflecting those assessments will be issued in December 2021 for taxes due in. Gross Receipts Tax Rate. Owners will still have the right to appeal to the Board of Revision of Taxes and the opportunity.

2 days agoMark Zimmaro. Net Income Tax Rate. If you disagree with your property assessment you can file an appeal with the Board of Revision of Taxes BRT.

Philadelphia property owners are enjoying a two-year reprieve from reassessments and the tax hikes that often follow. Philadelphia County collects on average 091 of a propertys assessed fair market value as property tax. Mayor Jim Kenneys administration isnt reassessing all properties for tax years 2021 or 2022 instead giving the citys Office of Property Assessment time to implement a long-awaited new computer system make.

Use the Property App to get information about a propertys ownership sales history value and physical characteristics. Mayor Jim Kenneys administration decided this month not to complete a planned reassessment which would have been finalized in March. It will increase by an additional 98 percent next year according to the 2020 property assessments released this month.

Inaccurate or incomplete data could affect the results of the analysis. Following two years of property assessment increases and tax hikes for hundreds of thousands of Philadelphia homeowners values will remain largely unchanged for 2021. A bill that took effect Jan.

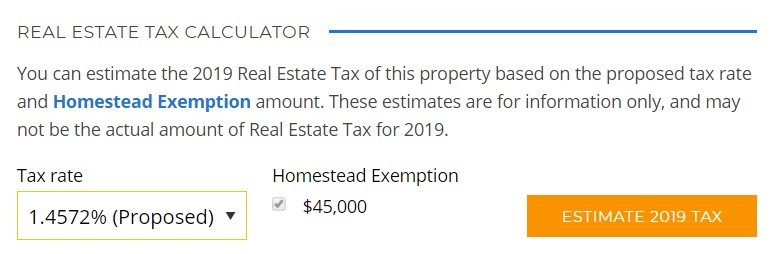

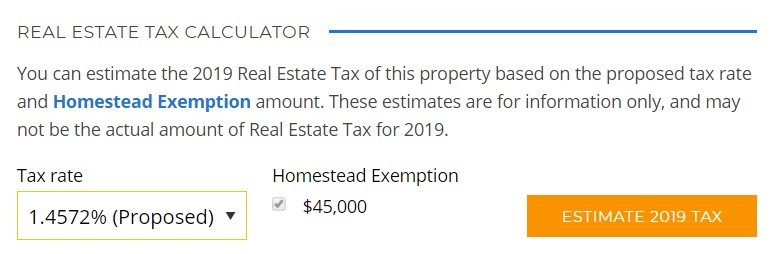

The Office of Property Assessment OPA determines the value of. Tax Year 2022 assessments will be certified by OPA by March 31 2021. The City calculates your taxes using these numbers but can change both the Homestead Exemption amount and the tax rate.

Philadelphia could see a short spike in construction in 2022 after a record number of developers applied for permits ahead of the citys expiring property tax abatement. Nisenfelds property assessment or the value used to calculate real estate tax bills increased 149 percent this year. For the 2022 tax year the rates are.

Active Duty Tax Credit. Report a change to lot lines for your property taxes. Antique Tennessee State Map 1888 Miniature Vintage Tiny Map Of Tennessee 9711 In 2022 Tennessee Map Tennessee State Map Miniature Map Financial Tax Consultant In 2022 Tax Consulting Equity Pin On United States.

Several areas of South Philadelphia could see significant increases to their property taxes due to the citys latest reassessment which will go in effect for 2023. Please note that assistance for certain issues is limited from Dec 20 2021-Jan 3 2022. Enroll in the Real Estate Tax deferral program.

Only property owners whose values change will receive notifications. That means that most property owners will keep their current assessments and property tax bills if the citys tax rate remains the same. 1 shrinks the value of the 10-year abatement for new residential properties by 10 annually starting after the first year until.

Select a location on the map. The delayed filing and payments could. 091 of home value.

Philadelphia property tax rate 2022 Friday March 18 2022 Edit. Philadelphia is extending filing and payment dates for some business taxes until July 15 2020 in accordance with the federal extension provided by the IRS. The median property tax in Philadelphia County Pennsylvania is 1236 per year for a home worth the median value of 135200.

The table above shows the fifty states and the District of Columbia ranked from highest to lowest by annual property taxes as a percentage of the. To get started you can. Currently the Philadelphia property tax rate is 13998 and the Homestead Exemption is 45000.

Continue to use our balance search website to pay your Real Estate Tax until October 2022.

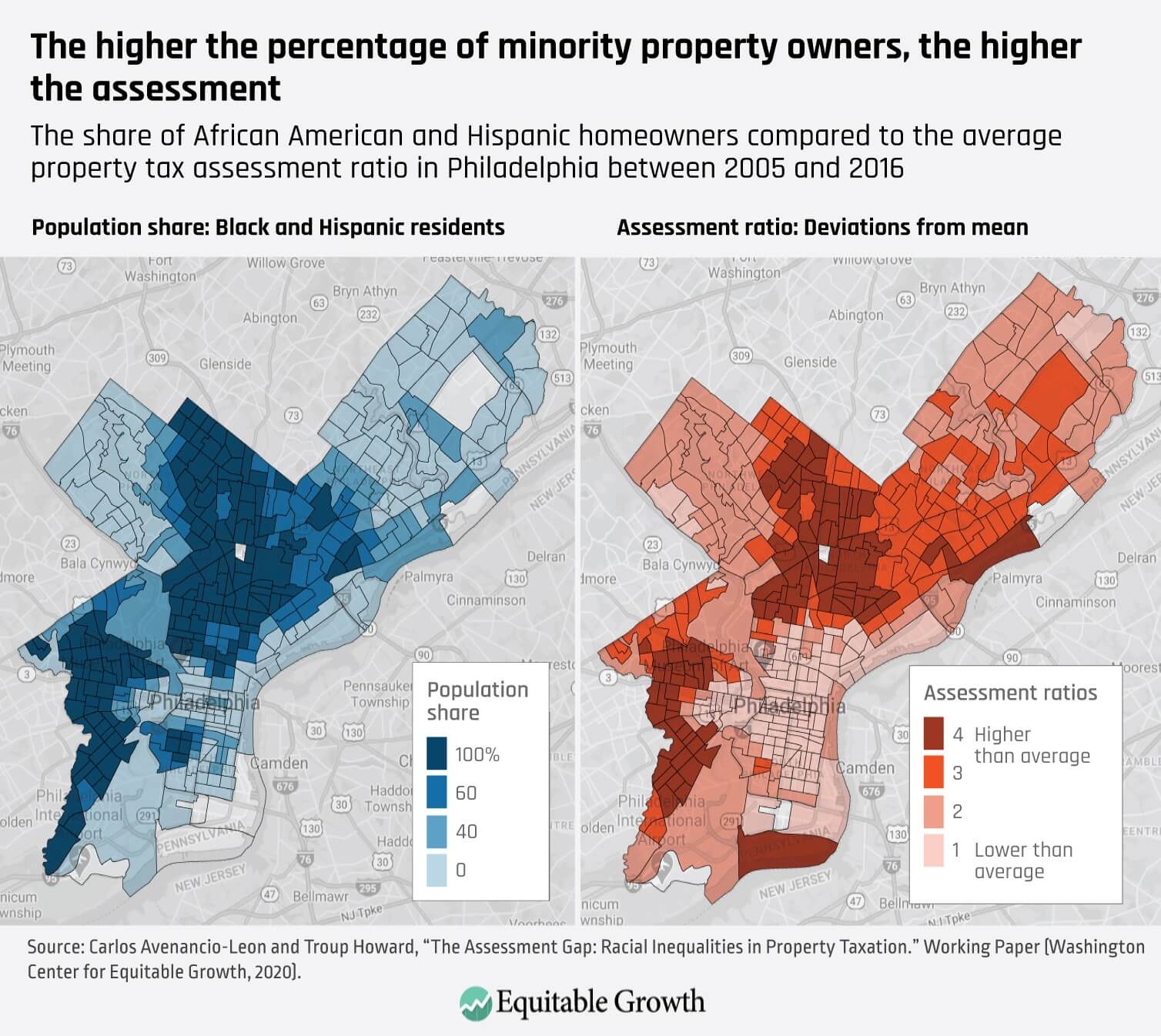

Misvaluations In Local Property Tax Assessments Cause The Tax Burden To Fall More Heavily On Black Latinx Homeowners Equitable Growth

Philadelphia County Pa Property Tax Search And Records Propertyshark

/cloudfront-us-east-1.images.arcpublishing.com/pmn/AOSJXQVTCVHSPMOI75C4M4MFM4.jpg)

How To Reduce Your Property Tax Bill In Philadelphia

2020 Philadelphia Tax Rates Due Dates And Filing Tips

Socked By The Pandemic Kenney Administration Forgoes Property Reassessments For Second Year In A Row Pennsylvania Capital Star

Handle With Care 2022 Property Tax Bills Department Of Revenue City Of Philadelphia

Philly Property Reassessments Mayor Kenney Proposes Wage Tax Reductions Other Relief Efforts To Counter Spikes In Value Phillyvoice

City Releases Property Tax Calculator To Assist Homeowners Department Of Revenue City Of Philadelphia

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

Philadelphia Cost Of Living 2022 Can You Afford Philadelphia Data

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Philly Realty Transfer Tax What Is It And How Does It Work Department Of Revenue City Of Philadelphia

This Map Makes It Easy To Compare Your Property Tax Change To Your Neighbors On Top Of Philly News

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star

/cloudfront-us-east-1.images.arcpublishing.com/pmn/45KPEXGRVNBCLBDASVZH3Y6PEQ.jpg)

How To Reduce Your Property Tax Bill In Philadelphia

/cloudfront-us-east-1.images.arcpublishing.com/pmn/SK6XMAEIOJGBDMV3ZQKBHE64PU.jpg)

Philadelphia Property Assessments For 2023 Tax Year What To Know